Promising Real Estate Investment

Company's Capital Development

(SAR)

2017

2020

2021

2021

2022

2023

Message

of

CEO

Our journey at First Avenue for Real Estate Development Company has been distinguished by a

strategic vision rooted in building robust alliances and partnerships with specialized

entities across various real estate sectors. This approach enhances the flexibility of our

business model, allowing us to blend our deep expertise in value creation with continuous

innovation. As a result, we are able to offer real estate opportunities and products

characterized by innovation and sustainability. These efforts contribute significantly to

improving the quality of life for citizens, residents, and visitors who witness the ongoing

achievements of Saudi Vision 2030.

We take great pride in the trust and aspirations placed in us by members of the real estate

sector. We view this as a considerable responsibility that demands seriousness,

perseverance, and commitment. This has motivated us to confidently and enthusiastically

embark on our initial public offering journey. This strategic move aims to fuel growth and

expansion in our distinctive projects in prime locations, allowing us to continue our

mission of building spaces and enriching human experiences.

Nader bin Hassan Alamri

Message

0F

CEO

Nader bin Hassan Alamri

Our journey at First Avenue for Real Estate Development Company has been distinguished by a

strategic vision rooted in building robust alliances and partnerships with specialized entities

across various real estate sectors. This approach enhances the flexibility of our business

model, allowing us to blend our deep expertise in value creation with continuous innovation. As

a result, we are able to offer real estate opportunities and products characterized by

innovation and sustainability. These efforts contribute significantly to improving the quality

of life for citizens, residents, and visitors who witness the ongoing achievements of Saudi

Vision 2030.

We take great pride in the trust and aspirations placed in us by members of the real estate

sector. We view this as a considerable responsibility that demands seriousness, perseverance,

and commitment. This has motivated us to confidently and enthusiastically embark on our initial

public offering journey. This strategic move aims to fuel growth and expansion in our

distinctive projects in prime locations, allowing us to continue our mission of building spaces

and enriching human experiences.

Board Members

Hassan bin Attallah Alamri

Chairman of the Board of Directors

Nader bin Hassan Alamri

CEO

Abdulsalam bin Abdulrahman Almajed

Board Member

Tarek bin Fawaz Al Ajlani

Board Member

Faisal bin Talal Bouzo

Board Member

Some Completed Projects

Some Projects Under Construction

First Avenue in Figures

Volume of Projects Under Implementation

+2 billion Saudi riyals

Compound growth in total assets over the last 3 years

59.8%

Sales growth rate in 2023

16.2%

Net profit in 2023

41,951,765

Net profit margin in 2023

17.6%

Total assets in 2023

498,764,862

Total assets/ total liabilities in 2023 2023

2.92

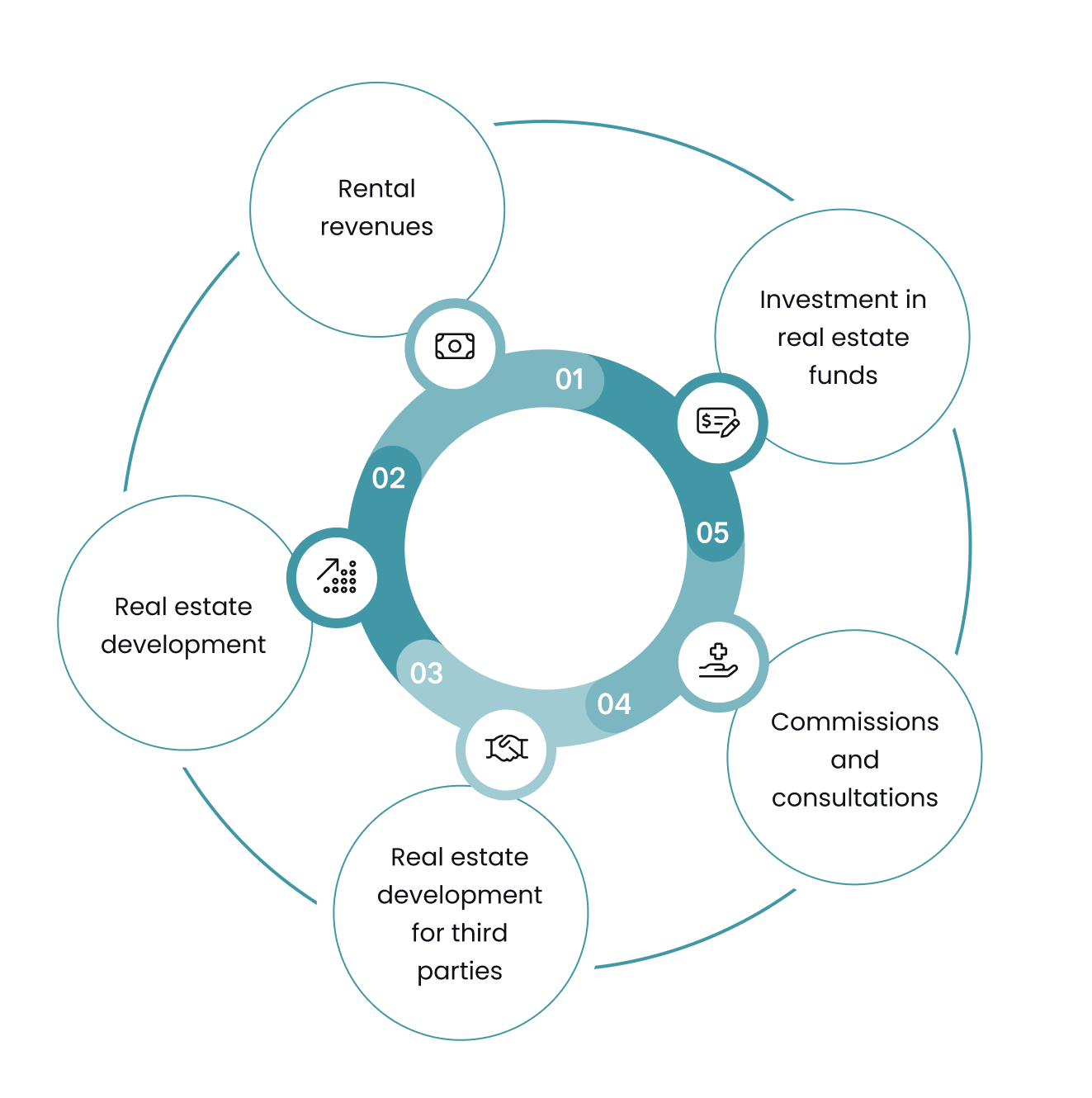

Company business model

Strengths and Competitive Advantages

The company's key strengths include:

Strategic allianceswith specialized real estate entities.

Robust capital structure

and flexible

organizational framework.

Diversified project portfolio across real estate sectors.

Premium real estate assets.

Accumulated technical expertise of our team.

Subscription Steps

Expected Offering

Schedule

The company intends to offer (16,423,953) ordinary shares with a nominal value of one riyal per share, representing (8.01%)of the company’s total capital after the offering.

-

Offering Period

Subscription begins on Tuesday 07/03/1446H (corresponding to 10/09/2024G) and continues for five (5) days, ending by the end of Monday 13/03/1446H (corresponding to 16/09/2024G).

-

Deadline for submission of Subscription Application Forms

Monday 13/03/1446H (corresponding to 16/09/2024G) 5 p.m

-

Deadline for payment of subscription amounts

Monday 13/03/1446H (corresponding to 16/09/2024G) 5 p.m

-

Announcement of final allocation of Offer Shares and notifying Investors

Monday 20/03/1446H (corresponding to 23/09/2024G)

-

Refund of surplus (if any)

Thursday 23/03/1446H (corresponding to 26/09/2024G)

-

Expected date of commencement of trading in the Exchange

Trading of the Company’s Shares in the Parallel Market is expected to commence after all the requirements have been met and all the relevant legal procedures have been completed, and the start of stock trading will be announced in local newspapers and on Saudi Exchange’s website (www.saudiexchange.sa).

Frequently

Asked Questions

The company's vision is based on the principle of creating investment opportunities through innovative real estate development and integration with specialized companies in different real estate sectors and diversified partnerships methodologies and structures, which grants the company the flexibility in adaptation to different opportunities, markets and conditions.

Through offering a portion of its shares for public subscription, the company aims to support its real estate development projects, expand its ownership base, and increase liquidity in its shares. This enables the company to achieve its strategic objectives and capitalize on future growth opportunities.

According to the requirements of the Rules on the Offer of Securities and Continuing Obligations, the offering is limited to the following categories of qualified investors: 1) Capital Market Institutions acting on their own behalf; 2) Clients of a Capital Market Institution authorized to perform management activities, provided that the Capital Market Institution has been appointed under terms that enable it to make decisions to accept participation in the Offering and to invest in the Parallel Market on the client’s behalf without the need for his/her prior approval; 3) The Kingdom’s Government, any governmental entity, or any international body recognized by the Capital Market Authority in the Kingdom (the “CMA”), the Saudi Exchange (the “Exchange”), or any other stock exchange recognized by the CMA, or the Securities Depository Center Company (Edaa); 4) Government-owned companies, whether investing directly or through a portfolio managed by a Capital Market Institution authorized to perform management activities; 5) Companies and funds established in GCC countries; 6) Investment funds; 7) Any other legal persons who may open an investment account in the Kingdom and an account with the Depository Center; 8) Natural persons who may open an investment account in the Kingdom and an account with the Depository Center and who: a) have made transactions in the securities market with a total value of not less than forty million Saudi Arabian Riyals (SAR 40,000,000) and not less than ten (10) transactions per quarter during the past 12 months; b) have assets whose net value is not less than five million Saudi Arabian Riyals (SAR 5,000,000); c) are working or have worked in the financial segment for at least three (3) years; d) have a CME-1 approved by the CMA; e) hold a professional certificate that is related to dealing with securities and accredited by an internationally recognized entity; 9) Any other persons defined by the CMA.

The minimum subscription limit is one hundred (100) shares. The maximum subscription limit for each qualified investor is ten million, two hundred forty-nine thousand, nine hundred ninety-nine (10,249,999) shares.

Holders of the offering shares are entitled to their share of any dividends declared or distributed by the company starting from the date of the company’s listing and for subsequent financial years. This is in accordance with the dividend distribution policy determined by the company, based on its income, financial position, capital requirements, future expectations, and other legal and regulatory considerations.

The company is committed to distributing dividends to its shareholders sustainably. It distributed dividends to its shareholders for the fiscal year 2022 amounting to 10.175 million SAR, representing 6% of the nominal value of the share (1 SAR) and approximately 18% of the comprehensive net income. Additionally, the company distributed cash dividends for the fiscal year 2023 totaling 20.3 million SAR, representing 11.5% of the nominal value of the share (1 SAR) and approximately 35% of the comprehensive net income.

Yes, there is a lock-up period of twelve (12) months from the start date of trading on the parallel market. This applies to substantial shareholders who own 5% or more of the company's shares.

The price range will be determined based on a book-building process and evaluation of demand from qualified investors, in coordination between the company and lead manager.

The company will utilize the 100% of the net IPO proceeds to finance its expansion plan and capital needs.

Trading of the company's shares on the market is expected to commence shortly after the completion of the share allocation process and after all the requirements have been met and all the relevant legal procedures have been completed, and the start of stock trading will be announced in local newspapers and on Saudi Exchange’s website (www.saudiexchange.sa).

Financial Advisor and Lead Manager

Receiving Entities